IncomeTax Refund Status कैसे पता करें AY 20-21| How to check Incometax Refund status for A.Y 2019 20 - YouTube

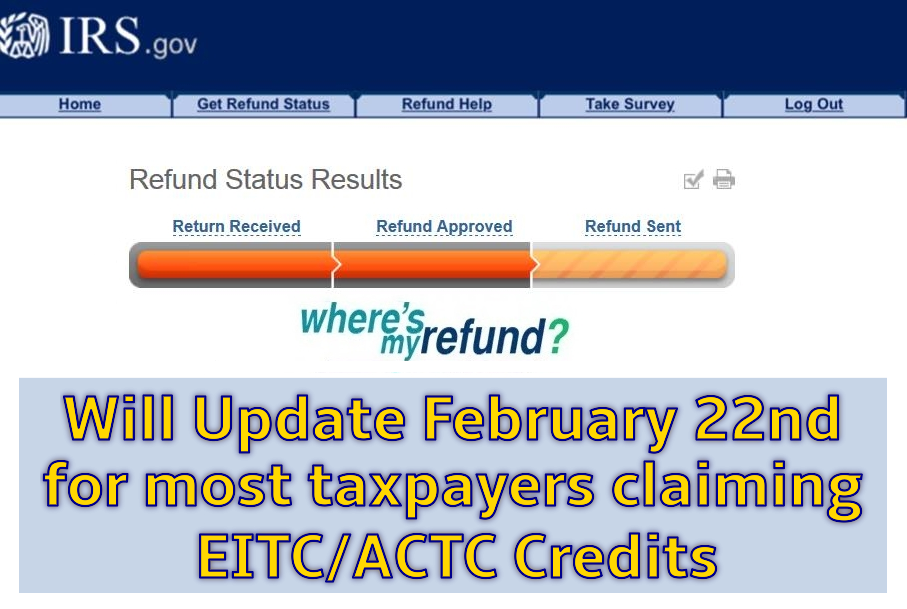

Where's My Refund?” will be updated Saturday February 22, 2020 with Deposit Dates ⋆ Where's my Refund? - Tax News & Information

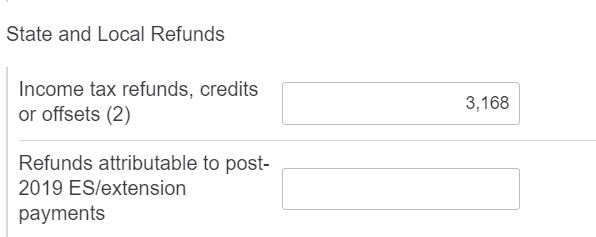

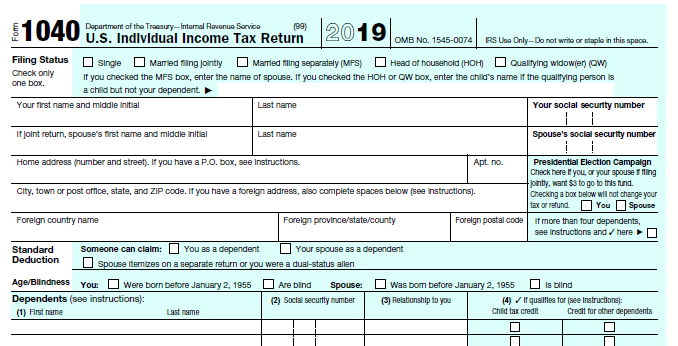

Solved: State Refund Worksheet-Why the number is different from 1099-G? - Intuit Accountants Community

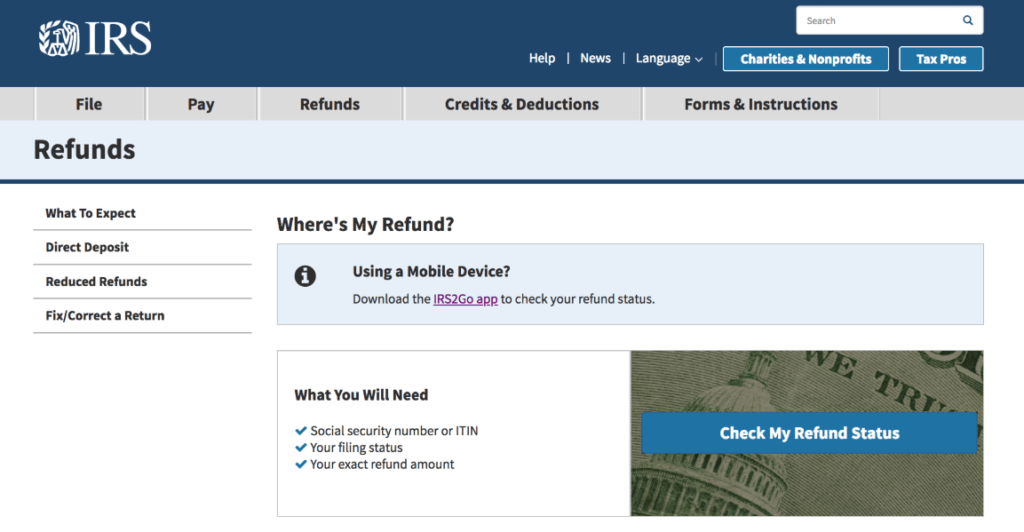

Where's My Refund - Where's My Refund Status Bars Disappeared We have gotten many comments and messages regarding the IRS Where's My Refund Tool having your orange status bar disappearing. This has

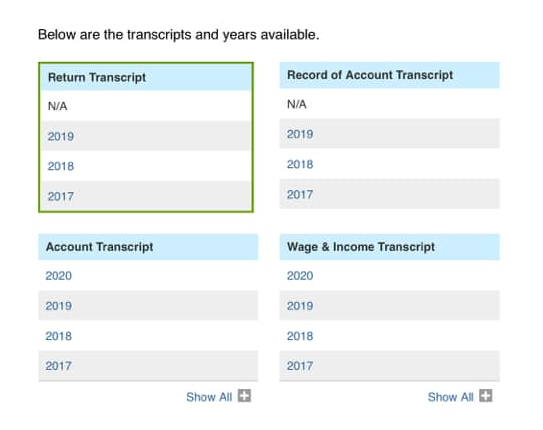

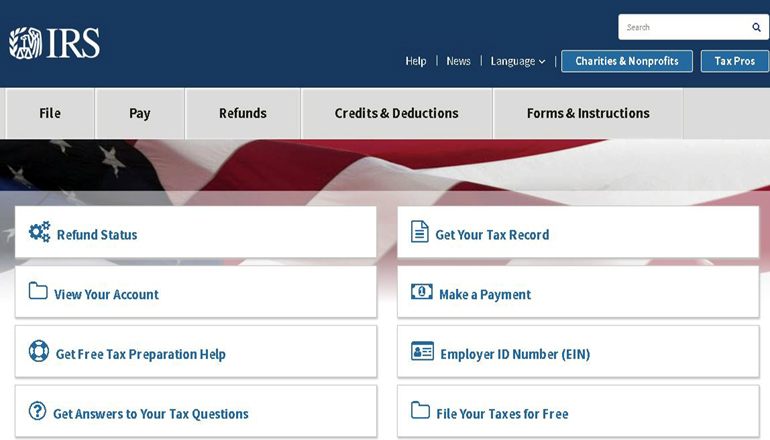

Review Your IRS Tax Records With Tax Transcript At No Charge ⋆ Where's my Refund? - Tax News & Information

![How much money do customers of Sprintax claim in refunds? [2019] How much money do customers of Sprintax claim in refunds? [2019]](https://blog.sprintax.com/wp-content/uploads/2019/06/Sprintax-average-federal-tax-refund-2019.jpg)

:max_bytes(150000):strip_icc()/WhereIsYourTaxRefund-85e9107ea88049bab6caf00d2d62dc71.png)